Is Kontor Space Limited's (NSE:KONTOR) Stock's Recent Performance Being Led By Its Attractive Financial Prospects?

By Simplywall | Posted 2024-04-05 | 10 min reading

10 min reading

Kontor Space's (NSE:KONTOR) stock is up by a considerable 24% over the past week. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. Particularly, we will be paying attention to Kontor Space's ROE today.

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Kontor Space is:

41% = ₹24m ÷ ₹59m (Based on the trailing twelve months to September 2023).

The 'return' is the amount earned after tax over the last twelve months. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.41 in profit.

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Kontor Space

How Is ROE Calculated?

Return on equity can be calculated by using the formula:Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Kontor Space is:

41% = ₹24m ÷ ₹59m (Based on the trailing twelve months to September 2023).

The 'return' is the amount earned after tax over the last twelve months. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.41 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Kontor Space's Earnings Growth And 41% ROE

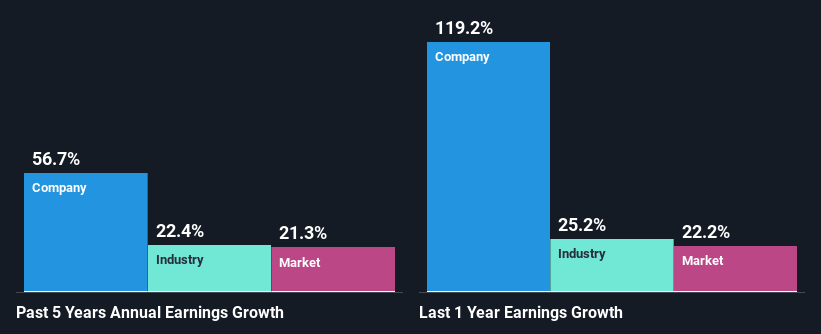

Firstly, we acknowledge that Kontor Space has a significantly high ROE. Second, a comparison with the average ROE reported by the industry of 7.6% also doesn't go unnoticed by us. As a result, Kontor Space's exceptional 57% net income growth seen over the past five years, doesn't come as a surprise.Next, on comparing with the industry net income growth, we found that Kontor Space's growth is quite high when compared to the industry average growth of 22% in the same period, which is great to see.

NSEI:KONTOR Past Earnings Growth April 5th 2024

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Kontor Space's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Kontor Space Using Its Retained Earnings Effectively?

Kontor Space doesn't pay any dividend to its shareholders, meaning that the company has been reinvesting all of its profits into the business. This is likely what's driving the high earnings growth number discussed above.