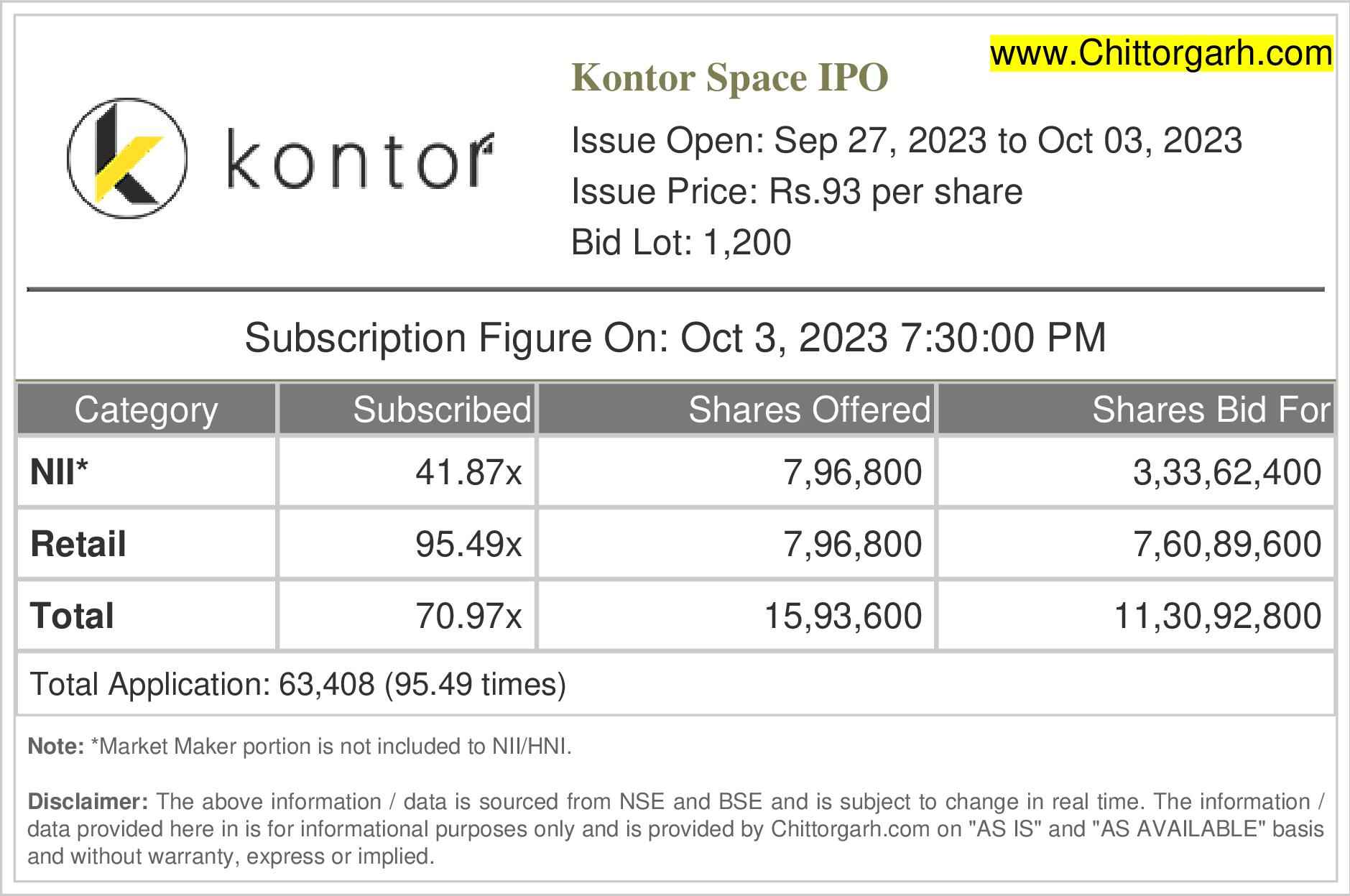

Kontor Space IPO Subscription Details

By Chittorgarh.com | Posted 2023-10-10 | 05 min reading

05 min reading

| Investor Category | Subscription (times) | Shares Offered | Shares Bid for | Total Amount (Rs Cr.)* |

|---|---|---|---|---|

| Others | 41.87 | 796,800 | 3,33,62,400 | 310.27 |

| Retail Investors | 95.49 | 796,800 | 7,60,89,600 | 707.63 |

| Total * | 70.97 | 1,593,600 | 11,30,92,800 | 1,051.76 |

Total Application : 63,408 (95.49 times)

Disclaimer: *The total amount is calculated based on the final issue price or the price in the upper price range.

* Market Maker portion of 86,400 equity shares not included.

Kontor Space IPO (Day-wise) Subscription Details (times)

| Date | Other | Retail | Total |

|---|---|---|---|

| Day 1 September 27, 2023 | 0.65 | 5.56 | 3.11 |

| Day 2 September 28, 2023 | 1.46 | 11.34 | 6.40 |

| Day 3 September 29, 2023 | 4.40 | 29.07 | 16.75 |

| Day 4 October 3, 2023 | 41.87 | 95.49 | 70.97 |

Kontor Space IPO Shares Offered

Kontor Space IPO is a public issue of 1,680,000 equity shares. The issue offers 796,800 shares to retail investors, 796,800 shares to other investors. The other investors include applicants other than retail i.e. HNI, corporates, institutions, (NII and QIB).

| Category | Shares Offered | Amount (Rs Cr) | Size (%) |

|---|---|---|---|

| Market Maker | 86,400 | 0.80 | 5.14% |

| Other | 796,800 | 7.41 | 47.43% |

| Retail | 796,800 | 7.41 | 47.43% |

| Total | 1,680,000 | 15.62 | 100% |

IPO Investor Categories

- Qualified Institutional Buyers (QIB)

Financial Institutions, Banks, FIIs, and Mutual Funds registered with SEBI are called QIBs. In most cases, QIBs represent small investors who invest through mutual funds, ULIP schemes of insurance companies, and pension schemes.

- Non-Institutional Investors(NII)

Retail Individual Investors (HNI), NRIs, Companies, Trusts, etc who bid for shares worth more than Rs 2 lakhs are known as Non-institutional bidders (NII). Unlike QIB bidders, they do not need SEBI registration.

NII category has two subcategories:

- sNII (bids below Rs 10L)

The Small NII category is for NII investors who bid for shares between Rs 2 lakhs to Rs 10 lakhs. The 1/3 of NII category shares are reserved for the Small NII sub-category. This subcategory is also known as Small HNI (sHNI).

- bNII (bids above Rs 10L)

The Big NII category is for NII investors who bid for shares worth more than Rs 10 Lakhs. The 2/3 of NII category shares are reserved for the Big NII subcategory. This subcategory is also known as Big HNI (bHNI).

- sNII (bids below Rs 10L)

- Retail Individual Investors(RII)

The retail individual investor or NRIs who apply up to Rs 2 lakhs in an IPO are considered as RII reserved category.

- Employee (EMP)

A category of eligible employees who have a reserved quota in the IPO.

- Others

A category of eligible shareholders or other investors who have a reserved quota in the IPO.

What is the difference between RII, NII, QIB and Anchor Investor?